“Greed, for lack of a better word, is good. Greed is right. Greed works.”

-Gordon Gekko from Wall Street (1987)

The aforementioned quote seems to be the credo not only of the famous Michael Douglas character but also of sellers and hedge funds within the note space recently. But, I digress.

So… when I initially started out in real estate investing a few years back, I, like everyone else in SoCal it seemed, wanted to flip houses. After all, it was the brightest, shiniest REI object out there. The HGTV shows and real estate investing clubs both taught us it was damn near impossible NOT to make at least $35K a deal in our market. Gurus left and right were falling over themselves pitching their programs, showing us how easy it was to do. And with its aging housing stock and many owners in financial trouble, Southern California had an ample supply of distressed housing. All you needed was access to money and a beat-up house under contract!

For a couple of years, finding a property to flip was my primary mission in life outside of my 9-to-5. I closely monitored the MLS, I called & emailed realtors, and I even sent out yellow letters in attempts to find deals on distressed homes, just as I was taught to do. There were some close calls and some accepted offers. But by Fall 2016, I had not closed on any properties for various reasons. As that year came to a close, I noticed fewer and fewer deals that were within my purchase criteria. Realtors and home sellers were no longer accepting bottom dollar for their crappy properties, as the market transitioned from a buyers’ market. Therefore, my offer prices were increasingly not competitive, which was disheartening. What changed? Sure, the economy had improved since the crash, but a significant contributing factor to the huge price appreciation in the market was all of the new investors (aka dumb money) that had jumped into the market, paying any price just to get a deal. Once that happened, the easy money in the rehab game disappeared seemingly overnight.

I mention all this because if you are a note investor, you should be seeing similar behavior throughout the non-performing note space. Almost four short years ago, I saw my first tape of first position NPNs ever. The seller set his pricing guidance at 50% of the lesser of either the unpaid balance (UPB) or property broker price opinion (BPO) value. And, it was not uncommon at that time for really distressed note assets to go for even less. Now, fast forward to 2018-19. These same sellers have increased their prices to 70, 80, or 90 cents on the dollar for like assets. In some cases, they even want par (100%) or more if the underlying property is located in certain states or if the value is far greater than what is owed. There are few reasons why this has happened. One, the supply of NPNs has been drying up since delinquencies have decreased year-over-year since the crash. Two, the biggest purchasers of NPNs on the secondary market have been bidding up the prices themselves. And finally, as was the case in the distressed real estate market, the industry has seen a deluge of dumb money invade the space. They follow the beck and call of the expensive so-called gurus who have “taught” them, and then they pursue note deals that make little financial sense.

Speaking of making little sense, not long ago I had a Facebook conversation with a note investor who said that in order to purchase notes successfully, he bases his bids on the Legal Balance and NOT the UPB. Huh? Come again? I disagreed and said that one should NEVER base off Legal Balance or bid above par. I only base my NPN bid on UPB or the property value. Remember — WE ARE BUYING THE PAPER, NOT THE ACTUAL REAL ESTATE! Sellers justify the Legal Balance basis because if the investor were to foreclose and get the house back, he or she will likely have more than enough profit. That is a big capital IF, as it limits the investor to one exit strategy. What if the borrower reinstates? Or what if an underwater borrower were to file Bankruptcy Ch. 13 and the BK Court authorizes a cram down? Guess how much I will be able to legally collect? No more than the value of the home! But none of these facts seem to matter as hedge funds continue to set that asinine pricing expectation and new foolish note investors increasingly fall in line.

Want proof that this trend is real? When Fannie Mae sells hundreds of millions of dollars in NPN assets ($200k home price range) to corporations and funds at 75-90 cents on the dollar, how much do you think that we, the small retail investors, will pay for these assets in the near future? Trust me, the only assets you may be able to get for less will be troublesome land contracts and/or the most bottom of the barrel assets in D neighborhoods.

So What Should Small Investors Do?

1) Under no circumstances should investors overpay for assets. PERIOD. FULL STOP. Don’t let your zeal for a deal (or more deals) get in the way of your wallet. STICK TO YOUR BUYING CRITERIA!

Again, when you buy a NPN, it is not a REO! Assuming that you cannot or will not get the note to re-perform, you will likely have to take care of a myriad of hard costs – servicing, force place insurance, property preservation, delinquent taxes, foreclosure legal fees, etc. – and on top of that be forced to wait 6 to 30 months for that foreclosure process to conclude. THEN, once you get that REO, you likely will have to pour in additional funds for rehab. So, if you end up losing money because you overpaid, don’t go looking for the seller. He or she does not give a damn about you or your problems! As an example, about a month ago, I submitted indicative bids (~50-65% UPB) to this hedge fund near me for a few assets, and the seller-broker responded that I was not in the ballpark in terms of their expectations. I didn’t counter. I didn’t ask what would have been a more appropriate bid. I shrugged and moved on. Well, not exactly… that experience served as the inspiration behind this blog post.

2) Maybe investors would be better off not fighting this trend and should consider alternatives.

Many of us came into this space specifically to invest in NON-PERFORMING notes. What if we were transition to PERFORMING qualified mortgages and seller finance notes?? This concept was recently presented to me at a note mastermind group and it literally blew my mind. Shout out to the homie CH for educating me on the benefits and advantages! If you are like me and you got into the NPN space to build capital in chunks, you can still accomplish that goal through buying a discounted PN. Once you do so, you can obviously hold on to it for the long money. But, you can also sell the full note to an IRA investor at a lower yield/rate which would result in a higher price than where it was bought. Or you could sell a partial note in such a way where you recoup your initial investment but still retain the rights to years of payments on the back side. Here are some examples to illustrate this:

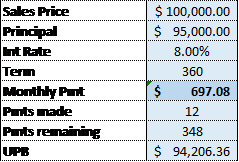

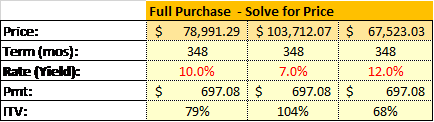

Let’s say that someone wants to sell their $95K note. It has been seasoned for 12 months already, and it has 348 payments of $697.08 left on the note. The UPB is around $94.2K. Let’s also assume that I am able to buy this note from the seller for almost $79K. I don’t want to keep this note so I offer it to a friend. They are thrilled with the prospect of making 8% yield on their money. Therefore, I could sell that note to them at the present UPB value ($94206.36). I just made roughly $15K!

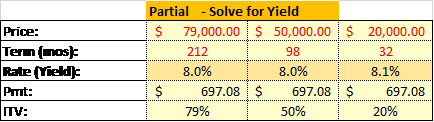

Alternatively, let’s say that instead of selling the whole note to the friend, I only sell some of the payments via a partial note. I, and the friend, have lots of options. I could sell the same payment stream for the first 212 months at a cost of $79K. What’s great about this from my perspective is the friend just paid for my note purchase in its entirety, but I still am entitled to the remaining 136 (or 348-212) months of payments! It’s like free money! Or what if the friend wants to get their feet wet note investing? He could buy the next 32 payments for $20K, and I could use that money in the meantime to buy more notes! There are other ways this could be structured but the point is that it could become a win-win for everyone involved, with the added bonus of not having to wait 6 to 30 months for a foreclosure.

Wrapping Up

Although we investors are justified in feeling a certain kind of way about the B.S. in pricing, pouting and complaining is not a terribly effective strategy either. History is replete with examples where companies had to adapt to the changing environment or die. Some did. Some could not. Which path will you choose?