The following are some common questions that potential investors may have concerning note investments. Hopefully, the answers will mitigate those concerns!

Wait, what is a note again? And what is the difference between a performing note and a non-performing note?

The technical definition of a note... a written promise by a person or business to repay a debt over time. However, colloquially speaking, the terms note, mortgage, and loan are used interchangeably.

A performing note is one where the borrower is making the payments on-time and the non-performing is one where the borrower has not made a payment in at least 90 days.

Can you briefly explain how note investing works? A picture describing it would be nice.

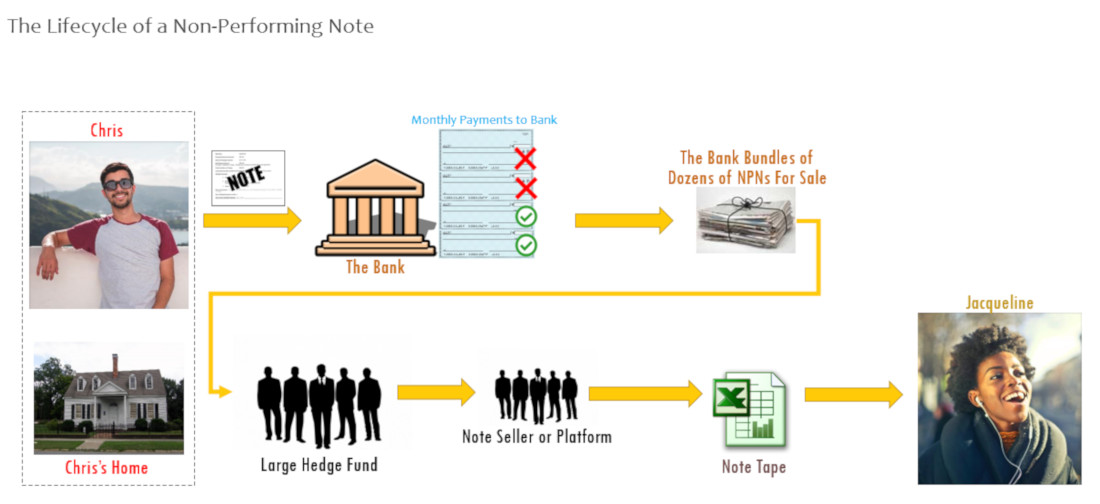

The following describes one aspect of note investing - in non-performing notes

- When Homebuyers (like Chris) buy a home, they sign a mortgage note, typically from a bank or credit union, which says that they must pay a certain amount over a certain amount of time

- When they make payments until they own the home free and clear, the loan/note is called performing.

- When they stop making payments (after 90 days), the loan becomes non-performing

- If the borrower defaults, sometimes the bank that originated the note will bundle like non-performers and sell them to a large hedge fund or other private entity. They do this because they are in the business of lending, not owning real estate. Plus, there are minimum liquid capital to assets ratio guidelines that banks have to follow.

- The hedge fund will take what it wants from this bundle and try to sell off the rest to private note investors like Jacqueline. These assets are listed on spreadsheets called tapes.

- On average, these assets can be sold anywhere from 30-75% of the Unpaid Balance of the respective loans.

- Before the note investor decides to purchase any notes, he or she conducts due diligence on the ones of interest. Due diligence will include condition of the property, property value, condition of title, lien amounts, etc.

- After the investor signs a purchase and sale agreement to acquire the assets, and the buyer receives the collateral file containing the original loan documents, the workout can begin.

- Primary workout options:

- Mortgage Loan Modification / Forbearance agreement - borrower agrees to changes to the original terms, normally in exchange for some upfront money. Leads to cash flow for investor.

- Deed in lieu of foreclosure / Cash-for-keys - borrower agrees to vacate premises, sometimes in exchange for some money. Investor acquires deed to property without the expense of foreclosure

- Foreclosure - borrower loses home at auction. Depending on the state where the property is, the duration and expense of this process can vary widely.

- If the investor acquires the deed to the property, he has many potentially profitable options available:

- Rent out the property

- Rent-to-own the property

- Seller finance the property

- Sell the property as-is to a buyer

- Rehab the property and do any of the previous 4 options

Do you have a nice PDF that explains note investing??

Yep... I sure do... Click here.

I have never heard of note investing before. Why is that? Is this new?

No, note investing is not new. There are people who have been investors for 30+ years. But, here are few reasons why you have not heard about it:

- The note investing community is small

- Investing in debt is alot more private and personal than stocks or real estate

- All the other forms of investing (rentals and rehabbing) occupy all the mind share, due to mass media. After all, there are no shows on HGTV about it.

Rest assured, note investing is not new and it is not a fad or get-rich-quick scheme.

Do you offer any note training or education?

I currently run the Monthly Brunches of Notes, which is a local meetup group in the Los Angeles area. Contact me if you need more in-depth training.

If you have an hour, please watch the below video as it provides an introduction to note investing.

I’m interested in investing, but I don’t have a lot of money in my savings. How can I fund the investment?

Although this is a cash business, you may have more money than you think. You have a couple of options:

- You can, of course, use cash funds from bank, savings, or brokerage accounts.

- Alternatively, let’s say that you have money sitting in an old 401k from a previous job. You can finally put it to work by rolling over those funds to a traditional or Roth self-directed IRA. THIS IS A GREAT VEHICLE FOR NOTES!!!! For more info about & IRS rules concerning the use of SDIRAs, contact me.

But what if I don’t like the investment opportunity you are being presented with?

For each investment, I will lay out the budget and gameplan. If you are not comfortable with the results of the presentation, then it is ok to decline participation. Maybe next time!

What is your minimum target for profit?

Although there are no guarantees, Terreva seeks a minimum of 20% for non-performing note investments and 10% for performing notes. It may not end up that way but the goal is to maximize the opportunity to make money.

How long will the investment last? In other words, when will I get my money back?

We hope that all NPN investments will be done in 8 months or less. However, it is realistic that it will take up to 6-18 months to execute an exit strategy for various reasons. I seek to invest in states or situations where these time risks are mitigated.

With performing notes, you will start receiving payments in under 60 days.

I live in California. But you indicated that your investments are 2000 miles away where I can’t drive by and see the property. That makes me nervous. What should I do?

A person who invests (even passively) in notes must understand that it is not the same as other traditional REI strategies. Sure, the condition of the property can be important (at asset purchase time) but it is less relevant afterwards due to protections in place for the benefit of “the bank”. Trust Terreva and the team that will be put in place for each asset.