It’s October. By now, all students are back in school. The weather is changing. The baseball playoffs have started (Go Braves!), and the football season is in full swing (unless you are an Atlanta Falcons fan like me but let’s not go there). I currently run a meetup in Los Angeles called the Monthly Brunches of Notes and September’s meeting had a “Back to School” theme. We discussed all what needs to happen before you purchase a residential note and how to calculate performing note yields. Likewise, for this month’s blog, I want to revisit many of the same topics covered during the meetup.

Whether you are an active note investor or a passive individual funding a deal, there are essential steps that must be taken before that purchase and sale agreement is signed. Please note that this is not an exhaustive list, and I will not examine every minor detail or nuance. But at a 50,000 foot level, this list does cover what needs to happen:

- Knowing your risk tolerance

- Knowing your note purchase criteria

- Performing due diligence

- Determining all likely exit strategies & knowing how to calculate potential profits

- Choosing your funding source

Knowing your risk tolerance.

Of the steps on this list, this is probably the most basic yet the most underrated because of its innate psychological nature. However, you do need to know your tolerance before considering any investment, whether it is in stocks, real estate, or bitcoin. I would ask myself the following questions to help ascertain the answer:

- How much money am I committing to (or seeking for) the investment?

- What is the minimum return that am I looking for?

- How long do I want to wait before seeing income and/or a profit?

- What risks do I want to take while making the investment?

This will help determine which note investments are right for you. For instance, let’s say that you are a new note investor and a convert from the rental world. You may be accustomed to seeing a check in the mailbox every month. Well, maybe the relative security of performing first-position notes is better suited for you. Or let’s say that once upon a time you traded stock options and your M.O. was to buy out-of-the-money calls and puts. That means that you are willing to trade higher risk for lower entry prices and higher yields. Then maybe you would be happy playing in the junior position note pond. Or not. But that is a decision that you have to make.

Knowing your note purchase criteria.

If someone presents to you a note deal, what do you need to know? In addition to figuring out the type of note that you want to purchase (non-performing, performing, firsts, seconds, etc), you also need to figure out which attributes of the underlying collateral will allow your investment to succeed. The information will help determine how much YOU should pay for a note and possibly give insight into the market for the collateral after gaining control of it after a foreclosure. Although we are buying notes, at the end of the day, the notes are still on residential real estate so those rules still apply. Here is what I consider when purchasing a note:

- Property location (region, state, city/town, neighborhood)

- crime

- weather

- schools

- proximity to stuff (jobs, entertainment, shopping)

- condition of the immediate neighborhood (unkempt, boarded-up houses?)

- in an active housing market?

- state and local governance

- The exterior condition of the asset (matters more on non-performing notes)

- The history of the note and the asset (non-performing/performing note)

- Total acquisition cost of note relative to true value (wholesale and after repair) of asset (non-performing note)

- Rental value (non-performing/performing note)

- Cash flow relative to total acquisition cost (performing note)

- Condition of the borrower (performing note)

Performing Due Diligence.

You have identified a possible note asset. The seller has told you the home is located in a great neighborhood, is worth $x thousand, and at their price guidance you are getting a great deal. Should you blindly trust the word of the seller? Of course not. TRUST BUT VERIFY FOLKS!! TRUST. BUT. VERIFY. Before signing any PSA, you now need to perform due diligence (DD) on the asset. There are actually 2 phases of DD. The first phase is the desktop DD, and it is done before submitting an indicative bid. Normally for this phase, little money is spent and most of information is found by spending a few minutes doing online research. The primary goal of this phase is two-fold: to confirm or guestimate property value and to quickly access exterior appearance. The second phase is the deeper, more comprehensive due diligence done after bid acceptance. During this phase, a few bucks WILL be spent to confirm critical facts about the asset – title and any liens against the property.

I accomplish phase 1 by using the free tools available on the Internet. Once I know the address of an asset, I put it into Google Maps or Bing Maps. Hopefully, there is a recent StreetView photo available. But I want to see what condition the home exterior is in “currently” and/or confirm that there is home there at all. You’d be surprised to know how many times I have encountered assets for sale that either burned down or were demolished by the city due to longstanding code violations. My suggestion here is to verify the existence of the home BOTH on StreetView AND on the satellite image because the aerial image is updated far more often. Also, check both Google and Bing maps. One site’s StreetView image may be more recent than the other. If both StreetView images are 12 months old and older, I would consider spending a few bucks to get someone local to swing by and take a few shots.

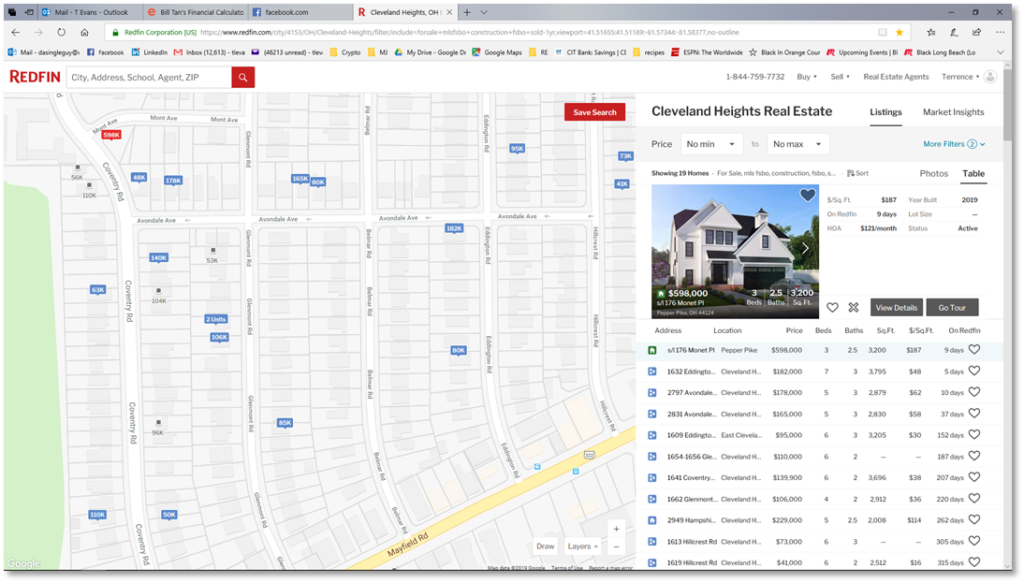

Now that you have an idea of what the home looks like, it is time to get an estimate of the its value. We can accomplish that by perusing the most popular real estate websites in use today – Redfin, Realtor.com, Zillow, Trulia, and even lesser known iComps. Once again, to get started, it is as simple as typing the address in the respective websites’ search windows. Please note that Redfin is actually an online brokerage so consequently it does not cover all locations within the U.S. Once the property address page loads, it should show a value estimate. Zillow calls their estimate a Zestimate, for instance. Newbies should know several things about these so-called estimates – few should be taken as gospel and they can vary wildly from site to site. But taken together from several sites, they can be useful as a guestimate of value. Ultimately to establish value (after-repair or wholesale value), you will need someone with access to the MLS to pull comps. However, that will come later in phase 2. Right now, you are just trying to establish value to the first order to see if your deal remotely makes sense.

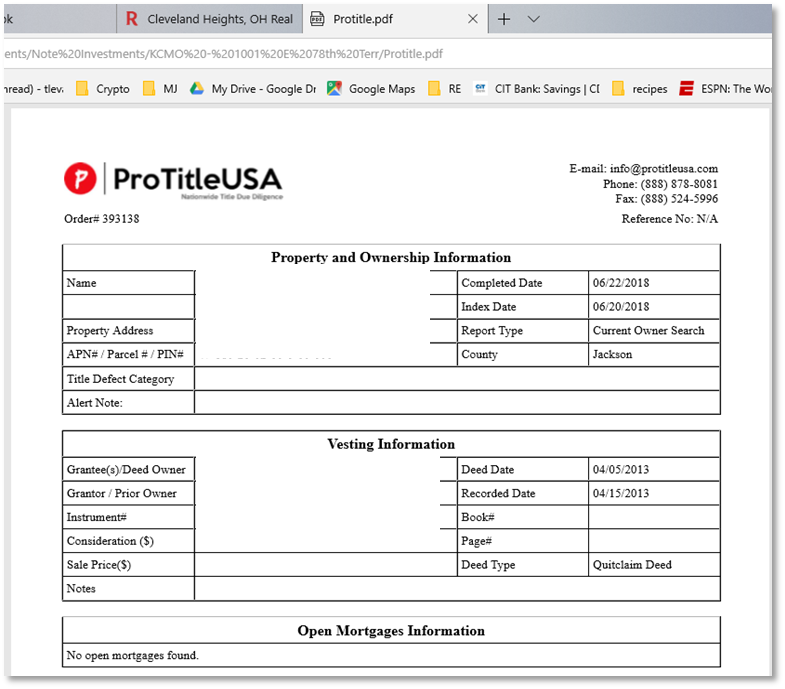

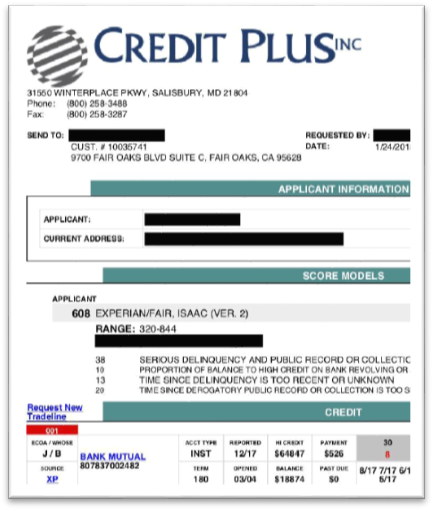

As I noted earlier, you perform Phase 2 of your due diligence after seller acceptance of your indicative bid. That is because phase 2 can cost up to a few hundred bucks to complete per asset. It generally does not make sense to perform phase 2 DD before acceptance because there is a high likelihood that you will not purchase the note asset. If you were to multiply the cost by the number of assets you evaluate on a tape, it would get really expensive quickly. Deep Due Diligence consists of the following:

- Hiring someone to take pictures of the home exterior (Real Estate agents or the website BPOPhotoFlow.com)

- Hiring a local real estate agent to do a Broker Price Opinion (BPO) on the property

- Running title, verifying mortgage position, and finding out all the liens on a property (ProTitleUSA and others)

- Running a credit report on a borrower (mostly on performing / re-performing notes)

- Engaging a local lawyer to review collateral file and help you navigate issues found running title

So, once all of your due diligence is complete, you should have most of the pertinent information to decide “Go/No Go” in regards to the purchase. If you did decide to proceed with the purchase, the DD will help you key in on the most probable exit strategies (for NPNs). Now, the next section on profit calculation is technically part of the due diligence phase as well, but I wanted to break it out on its own. But what I want readers to remember is this: conducting proper due diligence is all about the reduction of risk. If you don’t understand the true value of the asset, the market where the asset is located, or the true costs of acquisition (delinquent property taxes, property liens, etc.), you will risk overpaying for the note investment. If you do not know your borrower’s financials, then you should not be surprised if they are unable to keep up with payments later!

Determining all likely exit strategies & knowing how to calculate potential profits

Because I am an engineer and I like numbers, this may be my favorite part of due diligence. I also like it because it gets down to brass tacks. The numbers, not emotion, should determine whether you purchase a note or not. Now, there are lots of ways you can calculate potential profits for a note investment. You can:

- Be old school and use pen and paper (not recommended)

- Use a calculator

- Use a spreadsheet

- Use a computer or web analysis tool

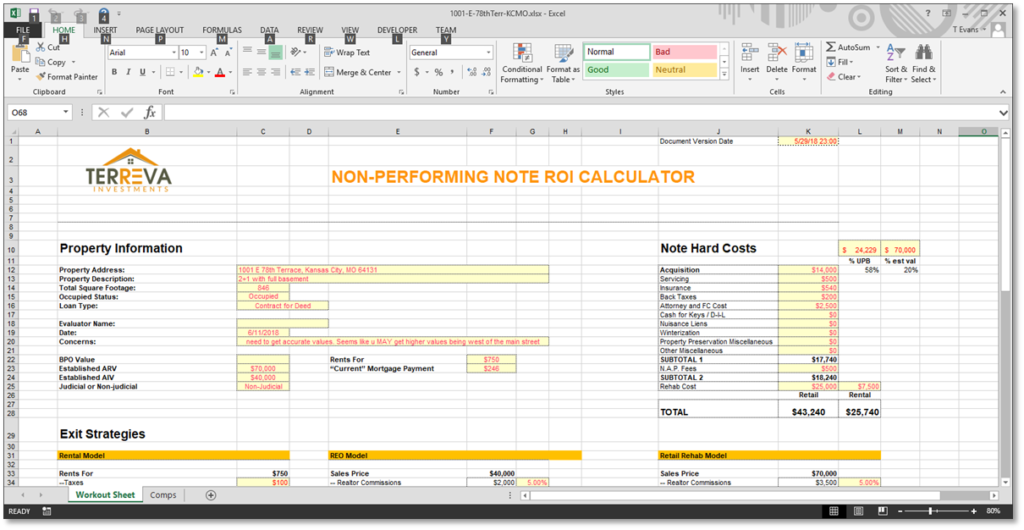

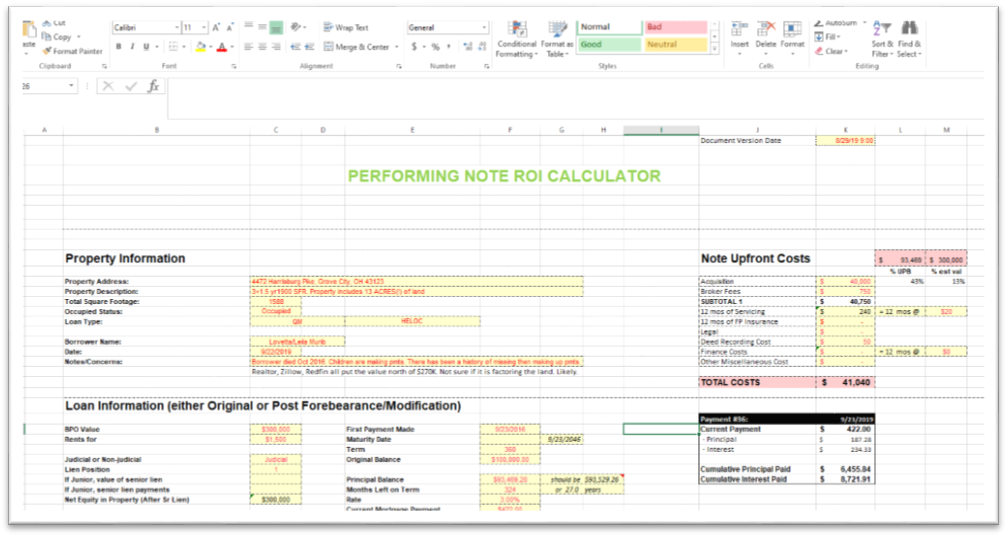

Now, based on the screenshots in the figures above, you may have guessed that I prefer the Microsoft Excel route. Consequently, that is what I will focus on in this article. I use spreadsheets for a variety of reasons. I am very experienced in using Excel from my main career. Spreadsheets are versatile and you can customize them however you want. Through macros, spreadsheets lend themselves well to automating repetitive & tedious tasks. Finally, the creation of spreadsheets is generally free or low cost, when compared with specific computer-based or web analysis apps.

When you create a spreadsheet to calculate potential profits for any note type, I believe that the spreadsheet should be clear, readable, AND have defined sections. After all, if you are trying to raise funds from investors, it will be far better received. As you can see in Figures 4 and 5, each of the analysis spreadsheets is essentially 3 or 4 sections.

For non-performing notes, I have a Property Information section which contains basic information about the collateral. I have a Hard Costs section which details the total estimated costs of acquiring a note and all costs to execute my exit strategies. Finally, I have an Exit Strategies section which contains many of the common exit strategies and calculates profits for each. Here are the primary exit strategy models in that section:

- Rental Model – what if I rent it out as-is after gaining possession

- REO / Wholesale Model – what if I sell to a flipper after gaining possession

- Retail Rehab Model – what if I fix and flip the home myself after gaining possession

- Rental Rehab Model – same as above but with minimal rehab costs

- Loan Modification Model – what if I mod the loan

- Loan Payoff Model – what if the borrower pays me off early

- Seller Finance Model – what if I were to create a new note after gaining possession

I tend to key in on just a few of these because of the kind of note investor I am right now. But I need to know how each of these exit strategies can play out so that I can be prepared.

For performing notes, again I have a Property Information section which contains basic information about the collateral. I have an Upfront Costs section which details the total estimated costs of acquiring a note and costs that I expect to incur over the first year. I have a Loan Information section which details many of the terms of the note that I would be purchasing – original balance, current balance, duration, lien position, rate, and payment. Finally, I have a Yield section which calculates the potential profit a few different ways. I also calculate what my yield would be if I were to re-sell the loan (whole or partial) or what my profit would be if I rented out the home subject-to the first mortgage.

Calculating return on investment versus yield

Return on investment, or ROI, is a basic financial figure of merit that allows you to determine simple profit. In the note space, it is normally used for non-performing notes. It essentially means that if the total cost of an investment is $5,000, then I should expect a certain percentage of that $5,000 back as profit when it is over. A 10% ROI in this case would yield $500 profit on top of the principal amount returned of $5,000. We sometimes employ the use of annualized ROI on longer term investments. It is simply an averaged return on an annual basis. So, let’s say that after 2 years your overall ROI on a NPN was 10%. The annualized ROI would be 10%/2, or 5%. Why does this matter? It is because the time to realize a profit for many is as important as the profit itself. It may make less sense to enter into a long-term investment knowing that your annualized ROI is less than the ROI of a year-long investment.

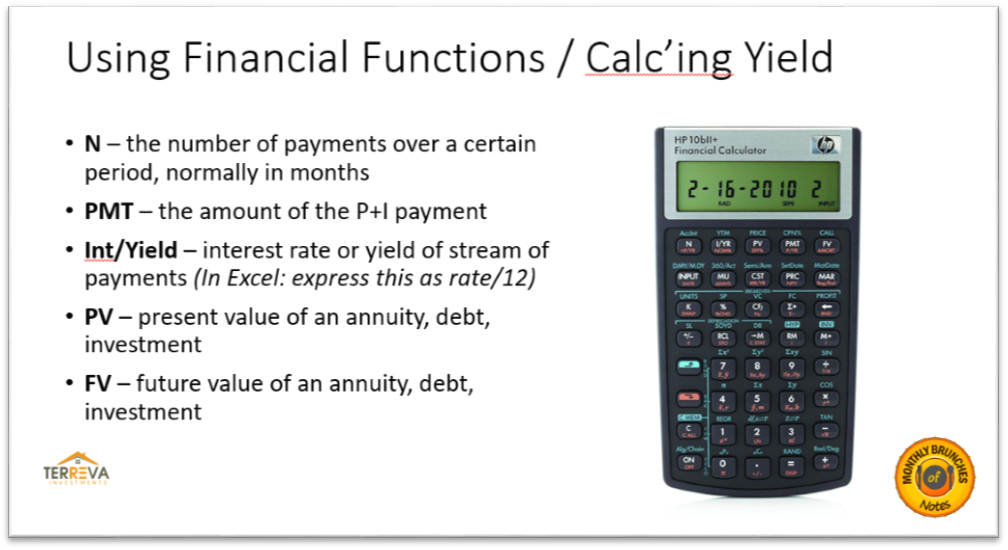

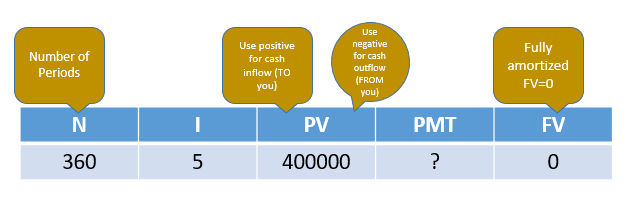

According to Wikipedia, yield is the % amount of cash that returns to the investor in the form of interest received. This figure of merit is normally associated with performing loans rather than non-performing loans. One can calculate yields by using a financial calculator like the HP 10bII+ or the financial functions in MS Excel / Google Sheets. The key variables are N, PMT, Int/Yield, PV, and FV. They are defined in Figure 6. If you know 4 of the 5 variables, you can solve for the unknown variable.

For instance, let’s say that I want to calculate my mortgage payment to a lender like Bank of America. I know the # of payments, interest rate, starting principal balance (PV), and ending balance (FV=0, since it is fully amortized). In Excel, you input each of these as variables per the PMT formula. On the calculator, I enter the number, THEN press the appropriate variable button. In the case of the example shown in Figure 6, I would enter:

- 360 “N”

- 5 “I”

- 400000 “PV”

- 0 “FV”

To solve for the payment amount, I simply press “PMT”. You should get -$2147.29 as the answer. It is negative because it is an outflow from you. Positive numbers represent inflow.

To take this a step further, what if my loan gets sold to a 3rd party for 90 cents on the dollar at origination? How would I calculate the yield in that case? You would do the following:

- PV is now .90 * 400000 = 360000 => 360000 “PV”

Press “I”. The result would be the yield (5.95%).

Homework question:

You want to purchase a performing note. It currently has a UPB of $30,000 after 5 years, the interest is 9%, and the P+I is $400. How much was the original amount owed? What is the term of this note?

Let’s say that I can buy this loan for 85 cents on the dollar. What would be my yield?

Choosing your funding source.

You identified an asset. You have performed your due diligence on that asset. You have crunched the numbers. The note asset still looks good to you. But before you sign the purchase and sale agreement, how will you fund this deal? You have a few options.

Your available funding methods:

- If you have the money sitting in a bank account, then this is the “easiest” option.

- If you have money sitting in a 401(k), 403(b), or similar tax-deferred account, then rollover that money to a self-directed IRA (SDIRA) and use that to fund. The big caveat here is this should already have been done prior to your deal as setting up a new account and rolling that money over can take a few weeks.

- Use an existing SDIRA – Traditional or Roth. Great for notes!

- OPM – Other People’s Money

- Joint Venture with other like-minded investors, share the profits equally

- Joint Venture with passive investors who will completely fund your deal while you split the profits.

In Conclusion…

And that’s the way it is. These are the major steps that one should take before purchasing a note. If you are new to the note industry, I know that there was a lot of content in this article that you will have to digest. But these steps are crucial when maximizing the chances of note investment success. It is not to say that you won’t encounter issues if you execute these steps perfectly. But 4 times out of 5, if you try to cut corners, you may miss the obvious red flags. If you need help in unpacking some of this information, feel free to email me or message me on social media.

-Terrence Evans

Founder of Terreva Investments and the Monthly Brunches of Notes

[email protected]